Tax Exemption

Upon our application, IHH has been granted “Tax Exemption Status” through the cabinet decision no. 2011/1799 dated 04.04.2011 according to Article 20 in Law No.4962 dated 30.07.2003 with reference to “Eligible for Tax Exemption” document no.48107 issued by Ministry of Finance on 08.05.2009.

THE PRIVILEGES GRANTED BY LAW TO THE FOUNDATIONS WITH TAX-EXEMPTION

1- According to Revenue Tax Law Cl.89 first paragraph charity organizations and foundations that work for public good will not include the donations they have received in return of a receipt in their income tax return provided that the donations do not exceed 5% of the total income.

According to Corporate Tax Law Clause 14 paragraph 1/b the corporations which donated to the charity organizations and foundations that are deemed to serve for the good of the public will get a remission of the donated amount from their income tax return provided that the total of the donations does not exceed 5% of the corporation’s profit.

The exceptions stated in Revenue Tax Law No. 193 Cl. 94 paragraphs number 7, 8, 9 and 14.

2- Delivery of goods and services that are covered in Value Added Tax Law No.3065 Cl.17 paragraphs 1 and 2 are not subject to value added tax. Moreover, delivery of goods and services to the hospitals, clinics, dispensaries, old folks houses, soup kitchens, orphanages and places for similar purposed run by non-profit organizations and charities are not subject to value added tax.

According to Value Added Tax Law No.3065 Cl.18 paragraph 2/c non-profit organizations and charities will be exempt from tax in their free delivery of goods and services.

3- Probate Law No. 7338 Cl. 3 paragraph (a) estates and inheritance donated non-profit organizations and charities are exempt from inheritance tax.

4 – According to Act of Fees No. 492 Cl. 59 paragraph (b) when charity organizations and foundations that are deemed to serve for the good of the public acquire estates and similar properties or the estates and similar properties that belong to charity organizations and foundations that are deemed to serve for the good of the public are exempt from fees of registration and endorsement.

5- According to Real Estate Tax Law No.1319 Cl.4 paragraph (e) and Cl.14 paragraph (c) the real estates and properties that belong or is allocated to charity organizations and foundations that are deemed to serve for the good of the public are exempt from real estate tax.

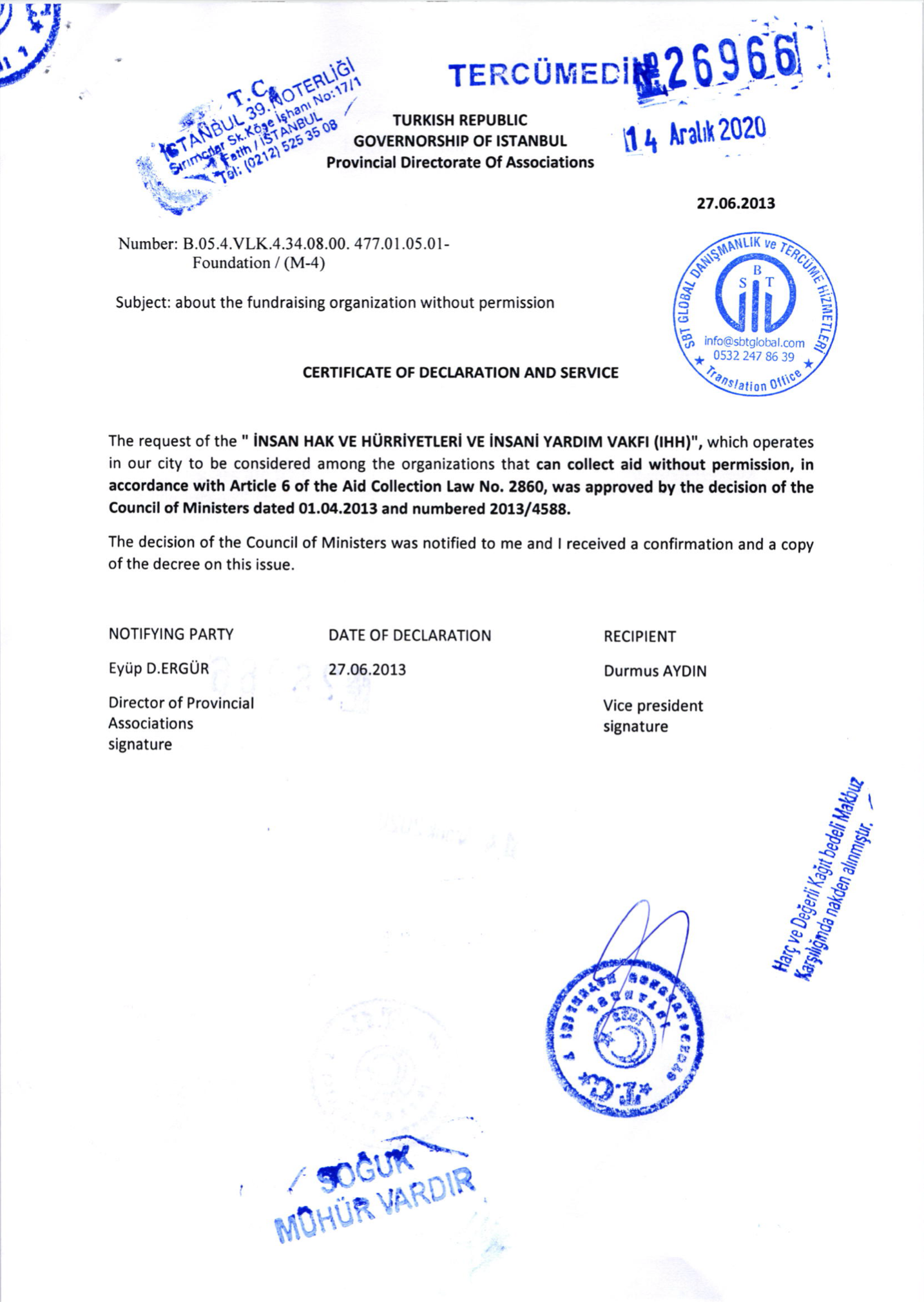

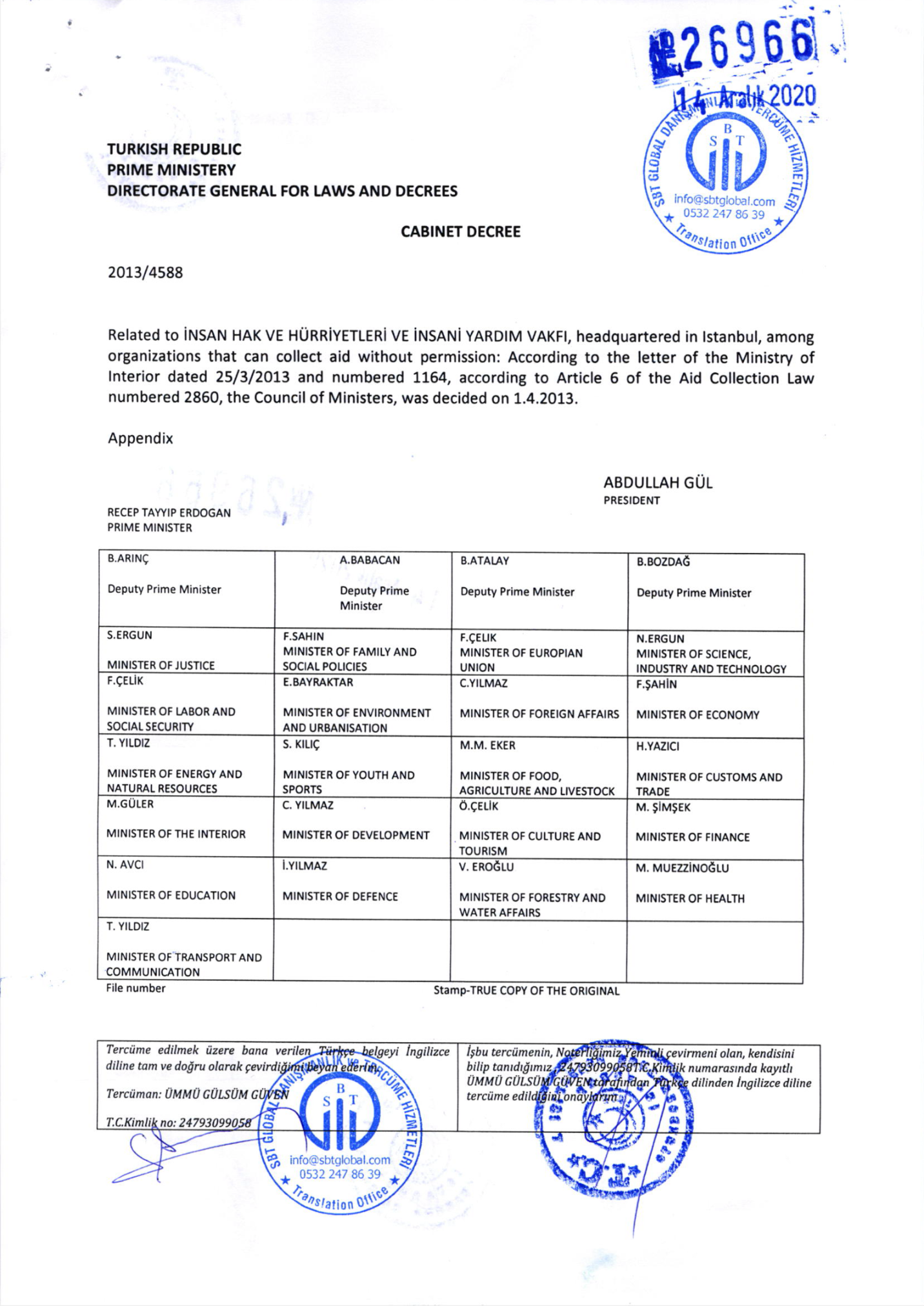

6- According to Charity Fundraising Law No. 2860 the charity organizations and foundations that are deemed to serve for the good of the public are authorized to receive donations without prior consent.

7- According to Law No. 748 Cl.1 Pertaining National Estates and Abandoned Waqf Properties and Estates Purchasable by Municipalities national estates and or real estate of waqfs can be sold to the charity organizations and foundations that are deemed to serve for the good of the public by the cabinet decision.

8- Customs Law No. 4458 Cl. 167 paragraph 7 the goods for educational, cultural and scientific purposes and scientific machines and gadgets, medical equipment for treatment research and diagnostic kits, animals for scientific research, biological and chemical substances, man-made medicinal substances, blood and blood plasma differentiation gadgets, substances for quality check of the medicines, which are imported by the charity organizations and foundations that are deemed to serve for the good of the public, will be exempt from customs tax provided that these goods are used not for commercial purposes but for charitable purposes.

9- According to Vehicles Law No. 237 Cl. 1/d the vehicles that are going to be used by the persons who are identified by the Presidency shall have an official (black) plate.

10- The charity organizations and foundations that are deemed to serve for the good of the public are included in the government protocol.

11- According to Public Procurement Contracts Law No. 2886 Cl. 72 Public Treasure can sell the real estate, which is registered under the public treasure estate and not in public use, to the charity organizations and foundations that are deemed to serve for the good of the public considering the value at the time of the sale. The real estate which is acquired in this way by the charity organizations and foundations that are deemed to serve for the good of the public, cannot be used or sold for purposes other than the original purpose. If the real estate is not used for charity purposes in five years’ time after the transaction the public treasure will buy it back from the charity organizations or foundation from the initial sale value.

12- According to the Regulation Regarding the Allocation of Real Estate of Waqf and Charity Cl.7 which was published on official gazette dated 04.06.1998 and numbered 23362 The charity organizations and foundations that are deemed to serve for the good of the public is one of the recipients to whom real estate of waqf and charities can be allocated.

13- According to Cultural and Natural Treasures Protection Law No. 2863 Cl.14 the charity organizations and foundations that are deemed to serve for the good of the public can receive the usufructary rights of cultural and natural treasure properties with the consent of the Ministry of Culture and Tourism provided that they are used for the public service on regular periods.

14- According to Turkish Criminal Law No.765 Cl. 483 those who offend or assault the charity organizations and foundations that are deemed to serve for the good of the public will receive the penalties mentioned in Cl.480 and Cl.482 depending on the nature of the offence.